Oil and gas - Middle east

The Middle East has dominated the oil market since the 1950s. The region has consistently supplied around 35% of the world’s oil for the last two decades and still holds 40% of the world’s oil reserves. For the gas sector, things were different. For a long time, associated gas was considered an undesired by-product that was often flared. Countries had little incentive to develop their gas fields as domestic markets were not well established and export routes non-existent. However the gas market is growing at twice as fast. According to BP, the Middle East accounts for 31% of oil production, 18% of gas production, 48% of proved oil reserves, and 40% of proved gas reserves.

The Middle East oil & gas storage terminal market size is approx. USD 3.3 billion. The market is projected to grow from USD 3.3 billion to USD 5.51 billion by 2029, exhibiting a CAGR of 7.7% during the forecast period. Some key market players in energy forecast that the demand for electricity in the Middle East will triple by 2050, accelerating the growth of fossil fuels. For buildings, electrification will continue, and natural gas will be displaced by electricity in households, including cooking, so that by 2050, 70% of buildings’ energy use will be covered by electricity.

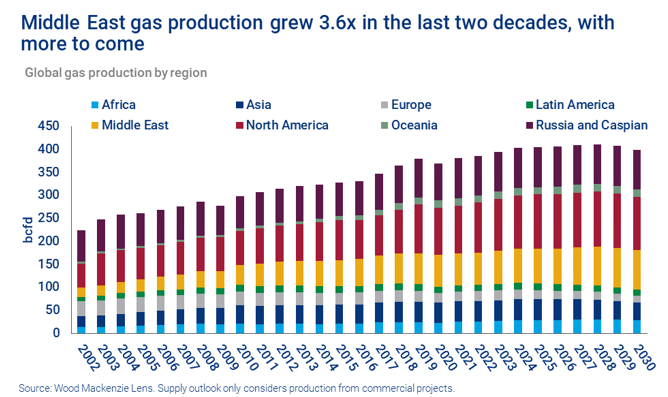

The Middle East, the second most dynamic downstream market, has been home to more than 30% of the world’s refining capacity expansion in recent years and will continue to witness an even larger share of the world’s firm refining projects in the coming years. Looking forward, Middle East gas production will continue to increase and should reach 86 bcfd in 2030. That’s an impressive 14 bcfd of additional supply, equivalent to the gas consumption of the entire European power sector. Colossal investments will be directed towards the North Field expansion and the Ghasha ultra-sour gas project.

Oil and Gas landscape

Major Oil and Gas Companies: National Oil Companies

- Saudi Aramco (Saudi Arabia): The world’s largest oil company by production and reserves.

- Iraqi National Oil Company (INOC): Manages Iraq’s oil resources.

- Adnoc (Abu Dhabi National Oil Company) (UAE): A major player in the UAE’s oil and gas sector.

- Kuwait Petroleum Corporation (KPC): Oversees Kuwait’s oil production and marketing.

- National Iranian Oil Company (NIOC): Manages Iran’s oil and gas resources.

Oil Reserves and Production

The Middle East is home to some of the world’s largest oil producers, including Saudi Arabia, Iraq, the United Arab Emirates (UAE), and Kuwait. The region holds a substantial portion of the world’s proven oil reserves. Saudi Arabia, in particular, is noted for its large reserve base and production capacity. One of the world’s leading producers, with production typically around 10-11 million barrels per day (bpd). UAE, Kuwait and Iran roughly produce 3-4 million barrels per day (bpd). Production levels can fluctuate based on global demand, OPEC decisions, and geopolitical events. Recent trends show that production might be adjusted in response to global economic conditions and climate policies.

Natural Gas Reserves and Production

Qatar and Iran are significant players in the natural gas sector, with Qatar having the world’s largest reserves of liquefied natural gas (LNG). Qatar’s North Field, shared with Iran’s South Pars field, is a key resource for global LNG markets. Iran also has substantial gas reserves but faces production challenges due to international sanctions.

Geopolitical Factors

OPEC: The Organization of the Petroleum Exporting Countries (OPEC) is central to oil price management. The group’s decisions on production quotas can significantly impact global oil prices.

OPEC+: This extended group includes non-OPEC producers like Russia. Their collaboration has played a key role in managing global oil supply and stabilizing prices.

Regional Conflicts and Stability

Regional conflicts, such as those in Syria, Yemen, and the ongoing tensions between Iran and other countries, can disrupt oil and gas supplies and impact global markets. The Strait of Hormuz, through which a significant percentage of global oil trade passes, is a critical chokepoint. Any disruption here can have global repercussions.

Economic and Market Dynamics

Oil Price is volatile and is influenced by a variety of factors, including geopolitical tensions, supply and demand dynamics, and broader economic conditions. Recent trends show oil prices can be quite volatile.

LNG prices are also subject to fluctuation, influenced by global supply-demand balance and regional market dynamics.

Investment and Diversification

Investments are ongoing in oil and gas infrastructure, including upstream exploration and downstream refining capacity. Many Middle Eastern countries are working on economic diversification strategies to reduce dependence on oil and gas revenues. Initiatives like Saudi Arabia’s Vision 2030 and the UAE’s diversification efforts are notable examples.

Environmental and Technological Trends

The oil and gas industry in the Middle East faces increasing pressure to address environmental concerns and reduce carbon emissions. This is leading to investments in cleaner technologies and sustainability initiatives. There is growing interest in renewable energy sources, with countries like the UAE making significant investments in solar and wind energy projects.

Technological Advances

Technologies such as enhanced oil recovery (EOR) are being used to maximize extraction from existing fields. The industry is embracing digital technologies, including AI and IoT, to improve efficiency and reduce costs.

Future Outlook

Economic Recovery and Demand

- Post-Pandemic Recovery: The global economic recovery post-COVID-19 will impact oil and gas demand. Economic growth and changes in consumption patterns will be key factors. Increase in global demand for various petroleum products, thereby leading oil producers to enhance their production capacity. This has resulted in increasing utilization of refineries and demand for the establishment of storage terminals. In addition, the demand for crude oil by-products such as diesel, LNG, aviation fuel, and gasoline has grown exponentially with a global increase in personal travel and air travel. Another factor driving the growth of the oil & gas storage terminal is the increasing demand for energy owing to rising population and rapid urbanization. Considering the Department of Economic and Social Affairs report, the world’s population is anticipated to be around 9.8 billion in 2050 and 11.2 billion in 2100. This will surely drive countries’ construction of oil storage terminals to suffice the country’s demand for oil or generate revenue by commercial use of the same.

- Energy Transition: The shift towards alternative energy sources and the implementation of stricter environmental regulations will influence the future of the oil and gas industry in the Middle East.

Investment and Economic Diversification Opportunities

Upstream and Downstream: There are opportunities for investment in both upstream exploration and downstream refining. The development of new technologies and enhanced recovery methods also presents growth potential.

Saudi Arabia’s Vision 2030:Aims to reduce reliance on oil and promote investments in non-oil sectors.

UAE’s Energy Strategy: Includes significant investments in renewable energy and diversification.

Qatar National Vision 2030: Focuses on reducing dependence on oil and gas and developing other sectors.

In summary, the Middle East remains a cornerstone of the global oil and gas industry, but it is navigating a landscape of evolving geopolitical dynamics, economic challenges, and a growing emphasis on sustainability and technological innovation. The region’s future will likely be shaped by how it adapts to these changes while continuing to leverage its substantial resource base.

Sources:

- https://www.fortunebusinessinsights.com/middle-east-oil-gas-storage-terminal-market-107134

- Wood Mackenzie lens

- International Energy Agency (IEA)

- OPEC Reports

- US Energy Information Administration (EIA)

- Company Reports and Industry Publications